Cobalt: Discovering the Mining History Of Northern Ontario

April 13, 2023

Avante Announces Acquisition of 1446199 B.C. LTD.

March 5, 2024

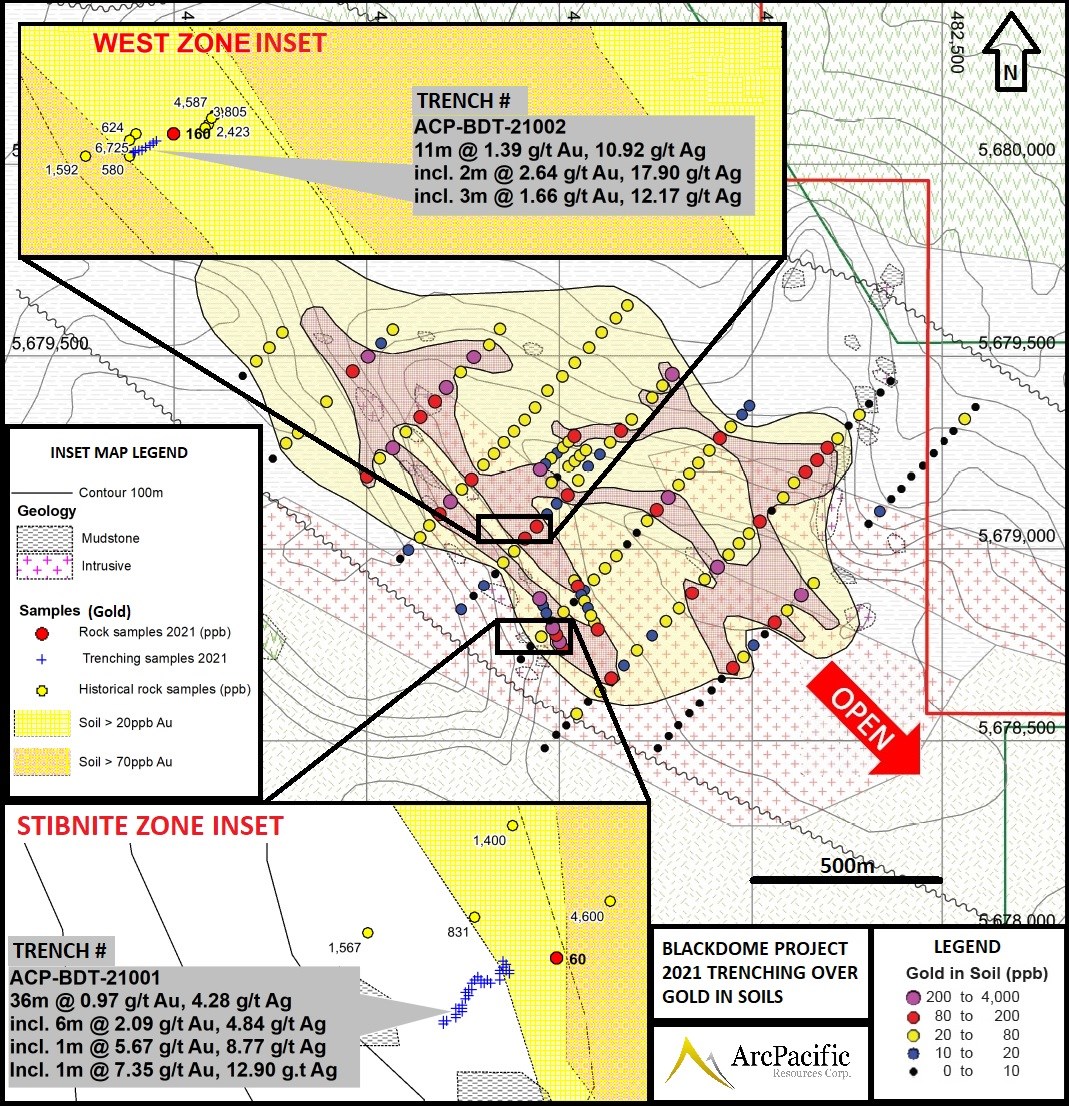

Vancouver, British Columbia–(September 7, 2021) – ArcPacific Resources Corp.(TSXV: ACP) (“ACP” or the “Company”) is pleased to report that the entire length of both trenches completed at the Blackdome project (the “Property”) in British Columbia, Canada, showed anomalous to high-grade gold and silver values. With the both trenches returning greater than 1 gram per tonne (“g/t”) gold equivalent (“AuEq”) (using gold and silver values only) over their entire lengths, and up to 7.35 g/t gold over a 1-meter segment. These results confirm epithermal-style gold-silver mineralization at the Property and indicate that it is likely responsible for the 1 by 2-kilometre gold-in-soil anomaly (see Figure 1 below). Geochemical evidence (including elevated antimony, arsenic and mercury) also suggests that the level of exposure is at a high level within the epithermal system, leaving significant potential for the entire extent of the precious metal or gold rich portion of the system to be intact.

Highlights

Adrian Smith CEO of ACP comments, “We are very pleased with the results from the first-pass program that was able to generate meaningful results, this speaks volumes for the potential at the Property. We are confident that we are sitting on an epithermal gold silver system existing within the bounds of the Property and based on the geochemical signatures, it looks like we are still sitting above what could potentially be the bonanza grade portion of the system. Based on these positive initial results we have now begun the permitting process to advance this project to the next stage including additional trenching and drilling.”

| Table 1: Blackdome Epithermal Au-Ag – 2021 Trenching Results (1-4) | ||||||||

| Trench | Zone | From (m) | To (m) | Interval (m) | g/t Au (Gold) | g/t Ag (Silver) | g/t AuEq 3, (Au+Ag Only) | % Sb 4 (Antimony) |

| ACP-BDT-21001 | Stibnite Zone | 0.00 | 36.00 | 36.00** | 0.97 | 4.28 | 1.03 | 0.21 |

| Incl. | 0.00 | 3.00 | 3.00 | 1.46 | 14.68 | 1.66 | 0.09 | |

| Incl. | 21.00 | 30.00 | 9.00 | 2.39 | 5.85 | 2.47 | 0.28 | |

| and Incl. | 22.00 | 23.00 | 1.00 | 5.67 | 8.77 | 5.79 | 0.12 | |

| and Incl. | 25.00 | 27.00 | 2.00 | 2.74 | 4.95 | 2.81 | 0.1 | |

| and Incl. | 29.00 | 30.00 | 1.00 | 7.35 | 12.90 | 7.53 | 0.09 | |

| ACP-BDT-21002 | West Zone | 0.00 | 11.00 | 11.00** | 1.39 | 10.92 | 1.54 | 0.009 |

| Incl. | 0.00 | 2.00 | 2.00 | 2.64 | 17.90 | 2.89 | 0.01 | |

| 3.00 | 6.00 | 3.00 | 1.66 | 12.17 | 1.83 | 0.01 |

** Entire length of trench.

1) Gold Equivalent (Eq) was calculated with the following metal prices; Gold (Au) $1800/oz and Silver (Ag) $25/oz. All metals reported in USD and calculations do not consider metal recovery.

2) Intervals taken as chip samples along approximate mineralized trends; true widths are unknown at this time.

3) Antimony values are not included in the Gold Equivalent (AuEq).

4) Antimony values are capped at 1% due to sample values exceeding assay limitations of 1%.

| Table 2: Blackdome Epithermal Au-Ag – 2021 Select Rock Sample Results | |||||

| Sample No. | Easting | Northing | Sample Type | Gold (g/t) | Silver (g/t) |

| D365207 | 482209 | 5679779 | Float | 8.37 | 2.71 |

| D365253 | 481715 | 5679990 | Float | 8.23 | 27.7 |

| D365303 | 481097 | 5679382 | Float | 5.14 | 14.2 |

| D365235 | 482310 | 5678875 | Float | 2.05 | 7.03 |

| D365252 | 481469 | 5678715 | Float | 1.59 | 10.45 |

| D365225 | 482280 | 5679711 | Outcrop (grab) | 1.39 | 3.17 |

| D365302 | 481074 | 5679363 | Float | 1.36 | 23 |

| D365304 | 481105 | 5679384 | Float | 1.34 | 18.95 |

| D365224 | 482280 | 5679711 | Outcrop (grab) | 1.2 | 2.6 |

| D365248 | 481395 | 5678651 | Float | 0.98 | 24.1 |

| D365254 | 481576 | 5678825 | float | 0.88 | 28.6 |

| D365246 | 481700 | 5679079 | Float | 0.71 | 17.85 |

| D365245 | 481700 | 5679079 | Float | 0.68 | 0.8 |

| D365244 | 481700 | 5679079 | Float | 0.67 | 11.5 |

| D365251 | 481414 | 5678686 | Float | 0.57 | 1.06 |

| Projection in UTM NAD83 Z10. Total number of samples 79, average grade of all samples 0.49g/t Au. |

Due to the limited scope of this initial program, only 2 of 6 known target areas were tested, and over 80% of the Property remains untested. Test pitting along the top of the ridge area was unsuccessful in reaching bedrock where historical float samples have run up to 19.3 g/t gold.

The elongated and unvegetated ridge is the center of the 1 by 2-kilometre open-ended gold in soil anomaly (shown above), where the next phase of planned work will require mechanical trenching or drilling to properly test the multiple target areas within this wide anomaly.

The hand trenching completed in this program represents the first trenching completed on the Property. Trenching locations were selected based on historic soil, grab and outcrop samples, where the historic samples include up to 54 grams per tonne gold in rocks and over 4 grams per tonne in soils. Based on the location of the float samples along the crest and margins of the broad ridge, it is probable that they are also locally derived.

The samples taken as part of the first-pass program (see table 2 above) were predominantly quartz and quartz carbonate vein material often displaying epithermal characteristics including crustiform, colloform, chalcedonic, banded, bladed, and vuggy textures and locally including up to 1% sulphides. Massive stibnite was also observed in 1-4-centimeter seams in quartz vein margins in the Stibnite Zone.

Substantial grades of antimony (often exceeding the assay limit of 1%) along with the elevated levels of arsenic indicate the epithermal system is exposed at a high level as shown in the Blackdome Geological Model above (see Figure 4). This model is based on a type-example of a Low Sulphidation (“LS”) epithermal system and suggests that that the best gold and silver grades are still located in a potential bonanza grade zone below. There is no record that the Property has ever been drilled.

The Property covers a prospective 3,479 hectares over an epithermal gold-silver exploration target in Southern, British Columbia. The Property is 60 kilometres south of the 1.6-million-ounce gold Newton deposit, 20 kilometres south of the 5.3-billion-pound copper and 13.3-million-ounce gold New Prosperity deposit and 65 kilometres north of the prolific Bralorne gold camp in southern, British Columbia which has produced over 4 million ounces and remains as an active gold mining camp.

QAQC

All samples were submitted to ALS Laboratories in Vancouver, British Columbia, Canada and analysed using 4-acid digestion with ICP-MS finish for multi-element analysis and Au 30g fire assay with ASS for gold values. Standards, duplicates, and blanks were included as part of the laboratories independent QAQC procedure.

Disclosure

The Qualified Person (“QP”) for the Company has not verified the historic sample analytical data disclosed within this release. While the Company has obtained all historic records including analytical data from the previous owners of the Properties and from various government databases, the Company has not independently verified the results of the historic sampling.

Qualified Person

Adrian Smith, P.Geo., is a QP as defined by National Instrument 43-101 for the above-mentioned project. The QP is a member in good standing of the Engineers and Geoscientists of British Columbia (EGBC) and is a registered Professional Geoscientist (P.Geo.). Mr. Smith has reviewed and approved the technical information disclosed above.

About ArcPacific Resources Corp.

ArcPacific Resources Corp. (TSXV: ACP) is a Canadian based exploration company expanding the exploration initiative at multiple historic past producing gold and silver mines in the Timmins Gold Camp, Ontario, and in the Nicola Mining Division in Southern British Columbia. The Company is focused on creating shareholder value through new discoveries and strategic development of its mineral properties. For further information, please visit http://www.arcpacific.ca.

ON BEHALF OF THE BOARD OF DIRECTORS

/S “Adrian Smith”

CEO and Director

The forward-looking statements contained in this press release are made as of the date hereof and ArcPacific Resources Corp. undertakes no obligations to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact us at info@arcpacific.ca or 1.778.331.3816.

The content published on Insidexploration.com is based on current events, historical data, company news releases, sedar filings, technical reports and information provided by the companies we work with. These publications may contain forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The publications on Insidexploration.com are for informational and entertainment purposes only and are not a recommendation to buy or sell any security. Always do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Please be sure to read company profiles on www.SEDAR.com for important risk disclosures.

...

Multimedia and analytical due diligence database for the investing community.

About Us

Contact Us

Disclaimer

Privacy Policy

Terms of Service

© Copyright 2022 insidexploration.com

Contact us: insidexploration@gmail.com

© Copyright 2025 insidexploration.com | Multimedia and analytical due diligence database for the investing community | Contact us: insidexploration@gmail.com