Avante Announces Acquisition of 1446199 B.C. LTD.

March 5, 2024

Updated August 2020

With Nickel gaining traction on the heels of resent comments by Elon Musk, we thought it would be a good time to update this article as many of the companies have evolved or been sold. The information on the deposits in the original article still hold true and tie into the updated portion, so they are definitely worth having a look at to gain a better understanding of the nickel space and the companies we will be discussing. Before we get into those companies, lets take a look at nickel as a whole and why demand is on the rise.

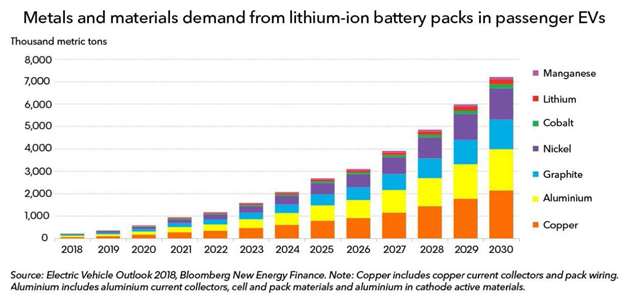

The battery market only consumes 3 percent of the available nickel but that figure is set to grow substantially. Some projections are forecasting that by 2025 there will be more that 140 million EV’s on the road, and by 2030 that number could double as the industry is leaning towards batteries with a higher nickel concentration as they tend to last longer. This makes EV’s a more attractive option to consumers and acts as an incentive to make the transition.

Before I get into junior miners that offer exposure to nickel we must first discuss the classifications and their uses within their respective industries. There are two types of nickel, Class 1 (sulphides) and Class 2 (Laterites).

Class 1, Nickel Is used in the manufacturing of Lithium ion batteries as it is a higher grade and concentration, which is perfectly suited to the process. Over the next 5-10 years demand will exceed the current production capacity of nickel sulphide deposits.

Class 2, Nickel is an ideal low-cost source for the stainless steel industry. Nickel laterite deposits are, in relative terms, abundant and located at shallow depths which makes them easier to mine.

According to the U.S Geological Survey, National Minerals Information Center

“Nickel is primarily sold for its use as refined metal (cathode, powder, briquette, etc.) or ferronickel. Around 65% of Nickel consumed by the Western world is used to make austenitic stainless steel , 12 % goes into super alloys used in aerospace engineering and combustion turbines like those found in electric power generation stations. The remaining 23% of nickel is divided between alloy steel, batteries, foundry products, and coinage amongst other things.”

Today the impact of the EV market is small in comparison to stainless steel, but future demands will play a significant role in not only the price of Nickel in my opinion but also in the economy, from the perspective of creating jobs and helping the environmental issues we face today. The demand for clean energy is on the rise in North America, while Canada is a leading producer of nickel, we still have deposits that are relatively untapped and some that are ready to go into production.

According to the U.S. Geological Survey, Mineral Commodity Summaries

“In recent years, production of refined nickel decreased due to the fact that stainless steel producers in Asia shifted to lower cost nickel pig iron. So while mine production in countries that supply direct shipping ore to nickel pig iron operations increased, mine production supplying refineries tended to decrease. However, production of nickel chemicals nickel sulfate used in the production of batteries has been steadily increasing.”

In light of all of this Nickel has been gaining strength of late and looks to be on the rise after hitting record lows in December of 2018 and in late 2019 broke the 6 dollar mark as supply and demand outlook remained positive for future nickel prices. After a small pull back the price of nickel is yet again making a push to break 7 dollars.

There are many reasons for this as the uses for Nickel are staggering on a global scale and some of the largest nickel mines in the Philippines have recently shut down and the country has banned nickel exports, creating a bit of volatility in the spot price. However, nickel seems to be in a steady uptrend while world stockpiles have been on the decline and EV manufacturers are calling for more supply of class 1 nickel due to the fact that Nickel quantities are increasing in batteries as they increase the amount of charge a battery can hold, thus allowing the EV’s to travel greater distances.

One such company is Tesla, the worlds leading EV manufacturer. Elon Musk came out and said that a very large contract would be signed if a company could produce nickel with a lowered carbon footprint by using more environmentally friendly ways of mining. His comments made waves in the nickel space and several juniors have benefited from his comments and surged 2 to 3 times their value.

Noble Mineral Exploration Inc. (TSX.V: NOB) is a Canadian-based junior exploration company holding in excess of 79,177 hectares of mineral rights in the Timmins/Cochrane area of Northern Ontario, upon which it plans to generate joint venture exploration programs. The Company also holds a portfolio of securities in its joint venture partners plus a gold-streaming and royalty interest in the Wawa-Holdsworth Property. The Company is focused on seeking Joint Venture Partners to further expand on all its exploration and development programs.

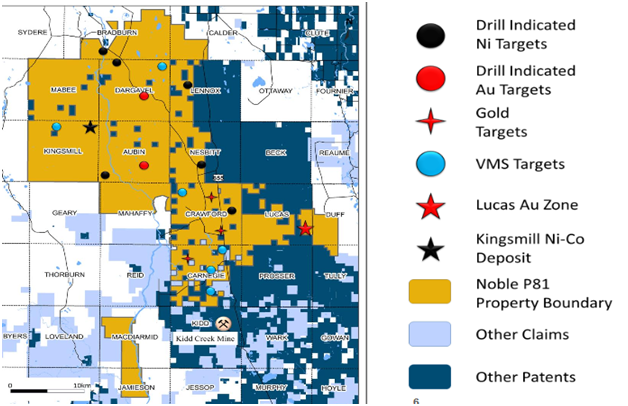

Noble signed a letter of intent that, upon implementation, would result in the net smelter return royalty interest on the approximate 52,000 Ha of patented mineral rights of Project 81 property being abolished entirely. In hopes of attracting joint ventures to the incredibly large land package directly north of Kid Creek Mine, which has produced in excess of 160mm tons of high-grade base metals but have yet to announce the closing of this deal.

In the mean time they have a joint venture drilling program going in Crawford Township with Spuce Ridge which I will cover in the next segment. Through the use of Albert Mining’s CARDS technology they identified 4 targets which produced similar numbers to the Dumont property. While they still have a lot of drilling to do to find out how big the system is and whether it is feasible, the initial metallurgical results look promising.

”We are very pleased with the results that Spruce has reported and in particular the core lengths containing consistent mineralization on this massive anomaly located within easy access from Highway 655, just north of Timmins, Ontario. The mineralogy results to date are very encouraging. We feel the Crawford Nickel-Cobalt project could contain significant tonnage and is close to existing infrastructure including the Kidd Creek milling complex. We look very much forward to Spruce advancing their exploration program as we continue to source additional Option and JV Partners for our extensive 79,000 ha holdings”

Vance White, CEO of Noble Minerals

The property was owned by a logging company for almost 100 years and saw little to no mining activity while the rest of the Timmins area was drilled into Swiss cheese so to speak. In hopes of finding the satellites of the Kid creek deposit, Noble did a range of geophysical work and identified many interesting targets of VMS, Gold, Nickel and copper as can be seen in this area map of identified targets.

As you can see there are 7 Nickel targets on the property and the land is near local infrastructure which could accelerate the project as they prove out the discoveries. I could go on for hours with all the grades and developments on this one but I think it’s best if you look at the company presentation to fully understand the scale of this project. While Noble Minerals should be viewed as a long term hold, the multiple other minerals found on the property align with optimism that further exploration will unlock several resources which may be viable given the regions track record of success. I highly recommend reviewing the presentation very carefully.

2019 Catalysts

-Closure of the NSR agreement

-Joint Venture announcements

-Drilling campaign results from jv with private investors

-Spruce ridge 2019 drilling plans

Company presentation

http://www.noblemineralexploration.com/i/pdf/NOB_PROJECT_81_Presentation_March_2019_Investors.pdf

Company Website

http://www.noblemineralexploration.com

Spruce Ridge Resources (TSX.V: SHL) joint ventured with Noble Mineral Exploration on the Crawford Ultramic Complex in 2018 and initiated an inaugural drilling program on the property. They completed their winter drilling campaign in early 2019 after Identifying drilling targets using geophysics and with the help of Windfall Geotek‘s CARDS system to compile the data on their project, they shrunk the target size of the property down to within 5%, thus allowing them to focus their drilling efforts in a far more efficient manner than what they would have, had they not had access to this revolutionary AI tool for mining exploration.

Spruce ridge announced the results on March 1st, 2019 from the winter drilling campaign and they were very encouraging to say the least. Four holes totaling 1,818 meters were drilled on the Crawford Ultramafic Complex. Three of which intersected serpentinized dunite with persistent nickel values greater than 0.25% Ni over core lengths of up to 291 meters. Using a lower threshold of 0.20% Ni, long intervals are present in all four holes, with a maximum core length of 558 meters. Individual samples of 1.5 meter core intervals reported up to 0.669% Ni. Potentially significant assays of cobalt, platinum and palladium were also reported.

Metallurgical work was recently performed on the drill cores and John Ryan of Spruce ridge had this to say…

“We are very encouraged by these preliminary results which suggest that a significant portion of the metals contained in this deposit may be recoverable by conventional metallurgical processes. We will continue to explore and evaluate the Crawford ultramafic complex, which is 3.8 kilometres long and 1.9 kilometres wide. So far, we have barely scratched the surface.”

Some of the Crawford Township highlights are as follows

-Crawford Township Property contains a total of 17 discrete HTEM conductor trends. Some of which are very continuous and some which are discontinuous (not present on every line but having the same strike direction). There are both Cu-Pb-Zn and Ni-Cu-PGM trends to consider.

-Trend 15 is a good example of Cu-Pb-Zn potential. The trend has a strike length of 2.2km and was tested with only one drill hole by Canico back in the 1960’s– Drill hole25049 intersected 0.46% Zn over 8.7 feet

.-Trend 7, is another example that covers a strongly magnetic feature that is likely a very large peridotite intrusion. This anomaly was never directly drill tested, but nearby drilling encountered over 1,500ft of mineralized host rock grading up to 0.4 % Ni (NI-CU-PGM Potential)

-Trend 9 is an east to west conductor, located in the SE corner of The Crawford Township Property and has a strike length of 1.1km. The best part of this anomaly was not drill tested. Drill holes 25073 & 25074 tested the eastern margin of this anomaly.

-Proximity to local infrastructure

Update* Interestingly this drilling campaign garnered some very positive attention that led to Spruce Ridge selling its interest to a newly formed spin out company called Canada Nickel Company. The company was formed as a subsidiary of Noble Minerals and has since gone on to list on the TSX Venture exchange. Therefore as part of our update we will discuss Canada Nickel Next.

2019 catalysts

–2019 exploration drilling campaign

-ongoing metallurgical testing results

-potential for a very large and viable deposit that may attract majors interest

Company website

https://www.spruceridgeresources.com/

Canada Nickel Corporation (TSX.V: CNC) – is focused on advancing the next generation of high quality nickel-cobalt projects to deliver the metals needed to power the electric vehicle revolution and feed the high growth stainless steel market. Located in the mining friendly jurisdiction of Timmins, Ontario and within the world famous Abitibi Greenstone belt, The Canada Nickel land package has the potential to become one of the largest nickel sulphide deposits in the world. With only 20 percent of 1 structure drilled, Canada Nickel already finds itself as the 12th largest nickel sulphide deposit in the world and they still have 5 more targets to explore, which have similar characteristic to Crawford.

The company was formed earlier this year as a spin out of Noble Mineral Exploration and has already made a name for itself with Nickel expert, Mark Selby at the helm as Chairman and CEO. Given that he was part of the team that brought Dumont to a shovel ready status, Mark was perfectly suited for this role and the benefits have become very apparent as he has navigated his way through this project very quickly. Dumont is very comparable to the Crawford Nickel-Cobalt project is terms of grade, size and metallurgy which allows CNC to leverage some of the work that’s gone into the project.

On February 26th, Canada Nickel Company officially started trading on the TSX venture under the ticker symbol CNC. Under the agreement with Noble and Spruce Ridge Resources; Noble would receive 2 million dollars and 12 million shares of CNC and Spruce Ridge was to receive 20 million shares for their stake in the project. The deal was a bit more complex but not really worth getting into but details can be found on Sedar.

By February 28th, Canada Nickel had sufficient enough drilling that they were able to put out a maiden resource estimate totaling 600,390,054 tonnes grading at .25% Nickel of Measured and indicated resource and an additional 310,496,263 tonnes grading .23% Nickel of indicated resource making the Crawford Nickel project the 12th largest nickel sulphide deposit in the world with only 20% of the structure drilled. On top of the nickel content there is a section of PGM’s that run in parallel to the nickel body. The best hit to date is 2.6 g/t palladium + platinum (1.3 g/t Pd, 1.3 g/t Pt) over 7.5 metres within 1.8 g/t (0.9 g/t Pd, 0.9 g/t Pt) over 12 metres at 123 metres downhole. This structure extends over 1.5 kms and continues to expand as they continue drilling.

Within the ore body there is a higher grade shell which will allow for steady cash flow in the early years of production. Diamond drilling core assay results to date allow for the delineation of the two higher grade (>0.30% Ni and >0.35% Ni) regions within the larger Higher Grade Zone (>0.25%Ni), which in turn are within the larger enveloping Low-Grade Zone (>0.15% Ni), all contained within the host ultramafic body of the CUC. The Higher Grade Zone has a minimum strike length of about1.57 km, is between approximately 160 and 230 m wide, and contains regions of incrementally higher grade nickel (i.e., >0.30% Ni and >0.35% Ni).

The Higher Grade Zone and internal regions of higher grade nickel remain open along strike to the west-northwest and at +650 m depth. With a great start to the project it was only natural that Mark would look to add some of the other prospective targets within Project 81 that were similar in composition to Crawford as highlighted by the work done by INCO in the 1960’s. Then on March 4th, Canada Nickel Company announced that they agreed to pay Noble $500,000 in cash and issue 500,000 Canada Nickel common shares to acquire the Crawford Annex property and the option to earn up to an 80% interest in 5 additional nickel targets within the Project 81 land package and in close proximity to Crawford.

These 5 additional targets are very important to the future of CNC as each target looks to be as big as Crawford or bigger. Drilling in the 1960’s already highlighted several nickel sulphide deposits within a geologically close proximity to one another, therefore CNC already knows where to go to drill and can grow their resource exponentially over the course of the next few months. For more information on these deposits please see the interview below.

The Recent tweets by Elon Musk sent the stock to almost 3 dollars from a listing price of .25 cents! It has since consolidated to the 2 dollar range. Interestingly as Elon tweets about mining nickel in more environmentally friendly manners, Canada Nickel responded almost immediately with an announcement of the launch of their NetZero Carbon initiative made possible by the fact that their tailings naturally absorb Carbon. This unique feature of the Crawford deposit take conventional carbon sequestration to a whole new level and has certainly garnered interest from the Tesla camp. Given that nickel from places like china and indonesia produce a ton of carbon in the refining process due to the fact they rely on coal and fossil fuels for power, yet again CNC can capitalize by going with an all electric fleet and refinery by utilizing Hydro electricity from the nearby dams.

The company is set to announce a resource update in the coming weeks and plan to have a PEA by the end of the year on the Crawford Ultramafic Complex. All the while they can contiue to expand the CUC and branch out and explore their other 5 prospective targets.

Upcoming Catalysts

For more information visit https://insidexploration.com/cnc/

2020 Update* Company stock ran from .09 cents when this was written to 80 cents before being acquired by Wallbridge Mining earlier this year.

Balmoral Resources (No longer Listed) is a multi-award winning Canadian-focused exploration company actively exploring a portfolio of gold and base metal properties located within the prolific Abitibi greenstone belt. The Company’s flagship, 1,000 km2 Detour Gold Trend Project hosts the resource stage Bug and Martiniere West gold deposits and the Grasset nickel-copper-cobalt-PGE deposit. Employing an aggressive, drill focused exploration style in one of the world’s preeminent mining jurisdictions, Balmoral is following an established formula with a goal of maximizing shareholder value through the discovery and definition of high-grade, Canadian gold and base metal assets.

Back in March Balmoral ran a private placement for 2 million dollars in order to fund their 2019 exploration program. Results have been coming back from their exploration efforts from 2018 and so far they have identified several areas of interest and have returned promising results on several prospective properties. The Abitibi green belt is a historically rich area for base metals and gold discoveries which is in part why I like this company. Let’s have a look at some of their projects and the planned activities for the summer campaign.

Grasset and Grasset Central Ni Deposit

Geophysical work on the property will be taking place this summer in order to expand on their drilling from last year in order outline potential extensions to both the recently discovered Type-1 high-grade nickel-cobalt sulphide zones and the very broad, near-surface disseminated nickel deposit. So far 2 nickel sulfide systems have been discovered and drilling will commence during the winter once the conditions allow to get started.

3G Nickel Properties

They recently completed airborne surveys of the area and have provided the company further support for their geological model. Two EM anomalies were identified, each stretching for several hundred meters. This series of recently discovered nickel sulphide occurrences in the Gargoyle Lake area of the Gargoyle property have kicked off a summer surface exploration campaign prior to an initial dilling campaign.

RUM Nickel project

Ongoing exploration on the property will be targeting high-grade, near surface nickel-copper-cobalt-PGE mineralization similar to that at the nearby Lac Rocher nickel deposit as a follow up to the recently announced (April 25th) high resolution airborne magnetic/EM surveys. Geological models developed from the Lac Rocher and Lynn Lake nickel-copper-cobalt deposits in Canada, as well insights from recent nickel sulphide discoveries in the Lapland belt of Finland, have focused the Company’s attention on this underexplored region of Quebec. The goal is to have individual targets ready for drill testing by the fall of 2019.

This article is focused on Nickel but it is important to note that Balmoral controls The Martiniere Property which is the largest land position on the Sunday Lake Deformation Zone (“SLDZ”) within the Detour Gold Trend Project. Located 45 kms east of and along the same geological trend,the nearby Detour lake Gold camp hosts a Proven and Probable Reserves of 498.4 Mt @ 0.96 g/t gold for 15.4 million ounces at a 0.50 g/t cut-off grade. The area they have focusing on bears a great resemblance to the Detour Lake area. So you can understand why this is worth the mention. The company’s initial estimates released in March 2018 outlined a resource of 591,000 ounces in the indicated and 54,000 ounces inferred split 73%/27% between open pit and underground resource.

Other notable properties include

-The 46% owned Northshore Property in Ontario with over 1 million ounces of gold

-The 100% owned N2 Property with 800,000 ounces

-The 100% owned Grasset Gold Zone

2019 Catalysts

-Results from summer exploration on multiple properties

-Announcement of the 2019 drilling program

-Rising demand for nickel supply and rising spot price in both gold and Nickel

-Potential interest from majors for both their nickel and gold assets

Company website

http://www.balmoralresources.com/

2020 Update* The companies stock has gone from .12 cents at the time of writing this article to .49 cents today

FPX Nickel is a Vancouver-based junior nickel mining company developing the large-scale Decar Nickel District in central British Columbia. Decar hosts the PEA-stage Baptiste deposit, which has the potential to become one of the largest nickel mines in Canada. The Decar Nickel District, which is the company’s flagship nickel property, is a greenfield discovery of nickel mineralization in the form of a naturally occurring nickel-iron alloy called awaruite. It represents a promising target for bulk-tonnage, open-pit mining. This deposit contains little or no sulphides, meaning it has little or no capacity to generate acid mine drainage. Initial metallurgical test work demonstrates the nickel-iron alloy is recoverable using conventional two-stage grinding and magnetic separation, followed by gravity concentration – and does not require chemical reagents thereby significantly reducing another potential environmental impact.

Four targets (Baptiste, Sidney, Target B and Van) have been identified at Decar from surface samples taken at 50- to 200-metre intervals where the alloy was recognized in outcrop and confirmed by proprietary selective assaying procedures. The nickel-iron alloy is assayed by Acme Analytical Laboratories Ltd. (an ISO certified laboratory) using a selective extraction process that dissolves only the nickel present as nickel-iron alloy, without dissolving the nickel that is locked within rock-forming silicate minerals. Following independent studies to evaluate the reliability of this alloy-specific analytical method, it has been certified by Smee & Associates Consulting Ltd. This assaying procedure is proprietary to FPX Nickel and provides the Company with a significant advantage, not only in evaluating the Decar Nickel District, but also in exploring for other nickel-iron alloy targets world-wide.

In February the company announced that the metallurgical testing achieved meaningful improvements over the results of previous metallurgical test work used as a basis for the Project’s 2013 preliminary economic assessment (“2013 PEA”), demonstrating significant increases in estimated nickel recovery and final concentrate quality, using conventional processing technologies.

Highlights

A comparison of the results of the 2019 metallurgical test program with the assumptions in the 2013 PEA

Overall, this isn’t an overly active company but as far as juniors go they have very interesting nickel deposits and while it may not be ideal for the EV market, there is still a massive demand for lower grade nickel for the stainless steel market as supply runs short and demand becomes higher.

Upcoming Catalysts

-Potential JV

-Rise in the price of nickel

-Continued metallurgy in order to optimize the value of the Decar property

Company Website

This article was meant to focus on junior mining companies with potentially large untapped resources in Canada that have potential future growth in an environment where Nickel spot price is increasing due to demand. As Nickel is considered by many to be the equivalent to petroleum for EV’s, it’s a matter of when not if the EV market will take hold and we see Nickel’s true value reflected in the Market.

Ways to connect with Insidexploration:

Website – https://insidexploration.com

Follow us on Twitter – @insidexplr – https://twitter.com/insidexplr

Join us on Facebook – https://www.facebook.com/Insidexplr/

Youtube Channel – https://www.youtube.com/c/insidexploration/

Linkedin – https://www.linkedin.com/in/insidexploration/

Disclosure

The thoughts and opinions expressed in my articles and research reports are my own and do not represent those of the companies I write about. I often buy and sell the stocks I write about and may do so at any point in time without warning.

Disclaimer

My articles and research reports should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided is derived from sources believed to be accurate, but cannot be guaranteed. I do not take into account the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g. prohibitions to investments due to law, jurisdiction issues, etc.) which may exist for certain persons. I am not a registered financial advisors and one should always do your own due diligence and consult a licensed investment adviser prior to making any investment decisions. Always reference www.SEDAR.com for important risk disclosures.

The content published on Insidexploration.com is based on current events, historical data, company news releases, sedar filings, technical reports and information provided by the companies we work with. These publications may contain forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The publications on Insidexploration.com are for informational and entertainment purposes only and are not a recommendation to buy or sell any security. Always do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Please be sure to read company profiles on www.SEDAR.com for important risk disclosures.

Multimedia and analytical due diligence database for the investing community.

About Us

Contact Us

Disclaimer

Privacy Policy

Terms of Service

© Copyright 2022 insidexploration.com

Contact us: insidexploration@gmail.com

© Copyright 2025 insidexploration.com | Multimedia and analytical due diligence database for the investing community | Contact us: insidexploration@gmail.com