Cobalt: Discovering the Mining History Of Northern Ontario

April 13, 2023

Avante Announces Acquisition of 1446199 B.C. LTD.

March 5, 2024

RNC will host a call/webcast on March 26, 2020 at 10:00 a.m. (Eastern Time) to discuss the fourth quarter results. North American callers please dial: 1-888-231-8191, international callers please dial: (+1) 647-427-7450. For the webcast of this event click [here] (replay access information below).

TORONTO, March 26, 2020 /CNW/ – RNC Minerals (TSX: RNX) (“RNC”) announces its financial results and review of activities for the years ended December 31, 2019 and 2018. All amounts are expressed in Canadian dollars, unless otherwise noted. For additional information please refer to RNC’s Management’s Discussion & Analysis (“MD&A”) and audited consolidated financial statements for the years ended December 31, 2019 and 2018.

Highlights

| 1. | Non-IFRS: the definition and reconciliation of these measures are included in Table 4 of this news release. |

| 2. | Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of RNC’s MD&A dated March 25, 2020. |

Paul Huet, Chairman and CEO, commented, “2019 was a year of transformation for RNC Minerals. With the acquisition of the Higginsville mine and mill in June, our company has matured into a growing, profitable gold producer with two operations feeding a centralized mill. Our fourth quarter results continue to build upon the success of the previous quarter despite the challenges associated with the bushfires in Australia in late 2019. I would like to take this opportunity to personally commend our personnel in Australia for an outstanding job, which ensured that despite these challenges our mill remained in operation with ample feed from our mines and stockpiles. These efforts were reflected in our results, driving both a beat to production guidance and finishing 2H19 with AISC of US$1,144 per ounce, below our guided range of US$1,150-$1,250 per ounce.

With respect to current operations, we are now mining from three sources: Baloo, Fairplay North and Beta Hunt, with opportunities for expansion at all three mines. As we work through our open pit optimizations at Higginsville, we look forward to announcing an updated LOM plan for Higginsville later this year. With operations performing well YTD 2020, we remain on track to meet our previously reported 2020 guidance of 90,000-95,000 ounces and AISC1 guidance of US$1,050-US$1,200 per ounce.

I would also like to highlight our early 2020 exploration success. The renegotiation of the Morgan Stanley royalty in December unlocked our 1,800 km2 land package surrounding the mill and, as we announced during January and February, we are seeing outstanding results from the drilling bit and our review of the large historical HGO database. I am extremely excited to see what this year has in store with our large exploration program at Higginsville; the first of its kind in many years.

Lastly, and certainly not least, we have experienced significant impact in global financial markets both on our share price and that of our peers as a result of the ongoing global COVID-19 crisis. I remind our shareholders and stakeholders that we have taken careful steps at our operations to prepare for potential disruptions, and we remain in constant contact with the local, state and federal health authorities. As always, our top priority remains the health and safety of our workforce and stakeholders.

We finished the year with an extremely strong balance sheet, nearly C$35 million in cash. We have continued to build stockpiles in front of the mill, just as we did ahead of the Australian bushfires last year. Once again, I would like to thank our personnel on site for their tireless efforts in preparing our operations during this period. I remain confident that with all our collective efforts we will get through this and all stakeholders can regain confidence once the global situation begins to improve and normalize.

Most importantly, I wish good health to all.”

COVID-19 Preparedness

As announced in RNC’s news release dated March 18, 2020, the Corporation has implemented strict control measures at its operations in response to the COVID-19 pandemic. A task force at RNC’s Australian operations has been established to ensure the operating sites remain as prepared and responsive to this evolving situation as possible. RNC is carefully monitoring the advice of local health authorities and has informed site personnel of the precautions that need to be taken with respect to travel to and from site, along with isolation periods should anyone exhibit symptoms consistent with COVID-19. RNC has also proactively employed a full-time nurse specifically to monitor the status of people entering and leaving site. Additionally, RNC has also sealed off both operations from any outside visitors not critical to business operations.

In order to minimize potential disruptions to supply chains, RNC is building additional critical supplies beyond normal levels. As part of our ability to manage the fallout from the December bushfires, ROM stockpiles are now growing steadily from three sources: Baloo, Beta Hunt and Fairplay North.

RNC will continue to monitor this fluid situation, with our top priority being the health and safety of its employees and stakeholders.

Table 1 – Highlights of operational results for the periods ended December 31, 2019 and 2018

| Three months ended, | Year ended, | ||||

| For the periods ended December 31, | 2019 | 2018 | 2019 | 2018 | |

| Gold Operations (Consolidated)1,2 | |||||

| Tonnes milled (000s) | 321 | 71 | 755 | 493 | |

| Recoveries | 90% | 95% | 91% | 93% | |

| Gold milled, grade (g/t Au) | 2.60 | 9.42 | 2.65 | 4.22 | |

| Gold produced (ounces) | 26,874 | 20,495 | 64,277 | 62,233 | |

| Gold sold (ounces) | 28,359 | 19,512 | 65,225 | 62,806 | |

| Average realized price (USD $/oz sold) | 1,451 | 1,324 | 1,368 | 1,261 | |

| Cash operating costs (USD $/oz sold)3 | 929 | 445 | 1,004 | 924 | |

| All-in sustaining cost (AISC) (USD $/oz sold)3 | 1,131 | 685 | 1,155 | 1,037 | |

| Gold (Beta Hunt Mine)1,2 | |||||

| Tonnes milled (000s) | 133 | 71 | 475 | 493 | |

| Gold milled, grade (g/t Au) | 3.81 | 9.42 | 3.11 | 4.22 | |

| Gold produced(ounces)1 | 16,290 | 20,495 | 47,642 | 62,233 | |

| Gold sold (ounces) | 17,561 | 19,512 | 48,716 | 62,806 | |

| Cash operating cost (USD $/oz sold)3 | 773 | 445 | 958 | 924 | |

| Gold (HGO Mine)1 | |||||

| Tonnes milled (000s) | 188 | – | 280 | – | |

| Gold milled grade (g/t Au) | 1.75 | – | 1.85 | – | |

| Gold produced (ounces) | 10,584 | – | 16,635 | – | |

| Gold sold (ounces) | 10,798 | – | 16,509 | – | |

| Cash operating cost (USD $/oz sold)3 | 1,182 | – | 1,136 | – | |

| 1. | In respect of HGO, for the period from acquisition being June 10, 2019 to December 31, 2019 |

| 2. | Includes third-party tolling, no third-party material was processed in the third and fourth quarters of 2019. |

| 3. | Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of RNC’s MD&A dated March 25, 2020. |

Consolidated Results of Operations

The fourth quarter 2019 consolidated gold production of 26,874 ounces was 6,379 ounces higher than the corresponding quarter in 2018 (20,495 ounces). Production during the fourth quarter of 2019 consisted of Beta Hunt underground, Baloo open pit and a small amount of stockpile material. The milled grade was 2.60 grams per tonne of gold (“g/t Au”), compared to 9.42 grams per tonne the fourth quarter of 2018. The higher grade in 2018 was the result of high-grade Father’s Day Vein specimen gold production.

Consolidated AISC1 was US$1,131 per ounce for the fourth quarter of 2019, an improvement of 4% over the third quarter of 2019 and 12% over the first half of 2019. The 2H19 AISC of US$1,144 per ounce came in below 2H19 guidance of US$1,150-$1,250 per ounce. This continued reduction in AISC was achieved despite the increased capital outlays arising as a result of the Australian bushfires, a major rebuild of an underground mining truck at Beta Hunt and pre-stripping capital costs associated with the ramp up of the Fairplay North open pit at Higginsville.

AISC1 costs were higher by US$446 per ounce sold compared to US$685 per ounce in the fourth quarter of 2018 which included sales from coarse gold production from the Father’s Day Vein discovery.

| 1. | Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of RNC’s MD&A dated March 25, 2020. |

Cash operating costs were US$929 per ounce sold on a consolidated basis for the fourth quarter of 2019, US$103 per ounce or 10% lower than in the third quarter of 2019.

With the HGO mill fed at 100% capacity, fourth quarter results from the combined Beta Hunt and Higginsville mines showed significant improvement over third quarter results,. This was despite significant challenges during December due to the Australian bushfires, which impacted the supply chain to the region. With critical supplies and tonnes stockpiled in front of the mill, processing operations were able to continue unabated.

Higginsville Gold Operation (HGO)

Gold production at Higginsville was 10,584 ounces at a milled grade of 1.75 g/t Au during the fourth quarter, an 84% increase from 5,756 ounces in the prior quarter. Grade was down slightly from the third quarter due to milling of lower grade Mt. Henry stockpiles during the Australian bushfires. The increase reflects the ramp up of mining operations at Higginsville, which now includes production from the both the Baloo and Fairplay North open pits.

At Higginsville, cash operating costs were USD $1,182 per ounce for the fourth quarter, US$504, or 74% higher, than in the prior quarter. The increased cash cost was largely due to the reallocation of processing costs inside the Western Australia business unit and several one-off items.

With Higginsville operations now fully integrated into the Western Australia business unit, internal processing charges have been normalized. This has resulted in the internal reallocation of processing charges between Beta Hunt and Higginsville. This is reflected by the reported cash operating costs in Table 1. Importantly this reallocation of costs does not change the consolidated rates for the Australian business such as cash operating costs and AISC.

Significant items, totaling approximately A$6 million, included work associated with the decision to build up run-of-mine (“ROM”) stockpiles ahead of the significant bushfires in Western Australian during the month of December. In order to achieve this, the Company elected to double-shift at Baloo in order to fast track pre-strip development and build stockpiles while maintaining normal feed to the plant. Mining at Baloo also transitioned into the underlying fresh rock which resulted in additional drilling and blasting costs. Lastly, costs were also impacted with increased dewatering operations associated with larger water inflows into the pit during heavy rains early in the fourth quarter.

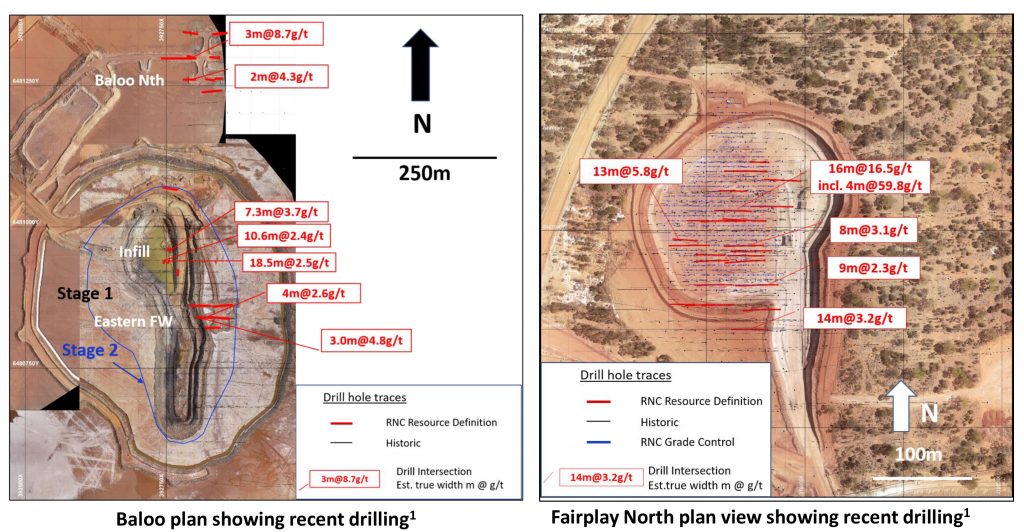

As previously announced, mining at Baloo Stage 1 is now forecast to continue to mid-2020 and Stage 2 will now be extended to January 2021. Recent drilling has the potential for Baloo to be extended even beyond January 2021.

At Fairplay North, located just 1 km from the HGO mill, mining is underway concurrently with Baloo, providing two sources of feed from HGO to the mill. An additional A$2.7 million in pre-stripping capital was associated with the Fairplay North pit during the fourth quarter as the renegotiation of the royalty at Higginsville allowed RNC to begin mining activities.

The Fairplay North pit will be mined in two stages, with Stage 2 expected to be completed by the end of third quarter 2020. However, as with Baloo, recent drilling has raised the potential for this to be extended.

Milling at Higginsville continued to perform well during the fourth quarter, with overall mill availability improving to 97% from 93% in the third quarter. This trend has continued during the first few months of 2020 and is expected to support RNC’s continued cost reduction strategy.

See RNC’s news release dated January 29, 2020 for more information on early drilling success at both Baloo and Fairplay North.

Beta Hunt Mine

Gold production at Beta Hunt was 16,290 ounces during the fourth quarter. Milled grades at Beta Hunt in the fourth quarter were 3.81 grams per tonne Au, higher than 2.93 grams per tonne in the third quarter but lower than in the fourth quarter of 2018 due to production from the high-grade Father’s Day Vein.

Beta Hunt gold production is mainly focused on the Western Flanks and A Zone mining areas. A number of stoping areas are being developed within the Western Flanks that will access some of the wider Beta Hunt stoping blocks (up to 20 metres wide). Combined production from Western Flanks and A Zone is forecast to increase to +50,000 tonnes per month while mining from these wider stoping blocks.

Table 2 – Highlights of Annual Financial Results

(in thousands of dollars except per share amounts)

| For the years ended December 31, | 2019 | 2018 |

| Revenue | $128,036 | $128,770 |

| Production and processing costs | 78,836 | 82,742 |

| Loss before income taxes | (7,716) | (7,911) |

| Net loss | (6,942) | (8,396) |

| Basic and diluted loss per share | 0.01 | 0.02 |

| Adjusted EBITDA1,2 | 18,284 | 17,979 |

| Adjusted EBITDA per share1,2 | 0.03 | 0.05 |

| Adjusted earnings1 | 15,913 | 13,886 |

| Adjusted earnings per share1 | 0.03 | 0.04 |

| Cash flow provided by (used in) operating activities | 15,179 | (8,316) |

| Cash investment in property, plant and equipment and mineral property interests | (25,391) | (13,013) |

| 1. | Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of RNC’s MD&A dated March 25, 2020. |

| 2. | Earnings before interest, taxes, depreciation and amortization (“EBITDA”). |

For the year ended December 31, 2019, revenues of 128.0 million decreased slightly by $0.7 million compared to 2018. Revenues of $33.4 million provided from HGO operations, acquired in June 2019, offset a decline in revenues resulting from the Reed Mine ($22.2 million) which was decommissioned in 2018.

Adjusted EBITDA and Adjusted Earnings of $18.3 million and $15.9 million were up slightly from $18.0 million and $13.9 million in 2018..

For a complete discussion of financial results, please refer to RNC’s MD&A and Audited Consolidated Financial Statements for the year ended December 31, 2019.

Table 3 – Highlights of RNC’s financial position

(in thousands of dollars):

| For the years ended | December 31, 2019 | December 31, 2018 |

| Cash and cash equivalents | $34,656 | $1,340 |

| Working capital surplus (deficit)1 | 26,506 | (18,992) |

| PP&E & MPI | 98,955 | 24,530 |

| Total assets | 177,777 | 58,012 |

| Total liabilities | 85,495 | 31,891 |

| Shareholders’ equity | 92,282 | 26,121 |

| 1 | Working capital surplus (deficit) is a measure of current assets (including cash and cash equivalents) less current liabilities. |

RNC ended 2019 with a strong cash position of $34.7 million, an increase of $33.3 million compared to December 31, 2018. The increase in cash position is net of $3 million debt repayment RNC elected to make to its lender thereby reducing its debt position from $34 million as of September 30, 2019 to $31 million as of December 31, 2019. Working capital was $26.5 million as of December 31, 2019, an improvement of $45.5 million compared to negative working capital of $19.0 million for the same period ended December 31, 2018.

Royalty Renegotiation Unlocks HGO for Exploration

In a news release dated December 19, 2019, the Corporation announced, effective January 1, 2020, a restructuring of the royalty held by Morgan Stanley Capital Group Inc. (“Morgan Stanley”) over a number of tenements at its Higginsville Gold Operations located in Western Australia. This revised royalty structure has allowed for a new strategic approach to many of the previously uneconomic mineralized zones throughout the HGO tenements.

In news releases dated January 23, January 29 and February 27, 2020, RNC announced comprehensive updates on exploration activities since the renegotiation of the royalty. Highlights include:

| 1. | Estimated true thickness. |

| 2. | True thickness cannot be estimated with available information. |

| 1. | Drillhole intervals are estimated true widths. |

| 1. | Estimated true widths. |

Beta Hunt Maiden Gold Mineral Reserve

On February 6, 2020 RNC filed the Technical Report for the maiden Gold Mineral Reserve of 306,000 ounces (3.45 Mt at an average grade of 2.8 g/t) at its Beta Hunt mine. The Gold Mineral Reserve forms the basis for Beta Hunt’s mine plan, which schedules base-load feed to the Corporation’s 100% owned Higginsville treatment plant. The Maiden Gold Mineral Reserve remains open for potential additions along strike and at depth from both the existing Gold Mineral Resource (underpinning the Mineral Reserve) and from exploration targets that will be drill-tested. On February 6, 2020, the Corporation filed a new technical report for the Beta Hunt Mine and HGO entitled “Technical Report Western Australia Operations – Eastern Goldfields: Beta Hunt Mine (Kambalda) and Higginsville Gold Operations (Higginsville)”. This technical report can be found on RNC’s website at www.rncminerals.com and at www.sedar.com under RNC’s profile.

Updated Dumont Feasibility Study: On May 30, 2019, RNC, in its capacity as Manager of the Dumont Joint Venture with Arpent Inc., a subsidiary of Waterton Precious Metals Fund II Cayman, LP and Waterton Mining Parallel Fund Offshore Master, LP, announced the positive results of an updated feasibility study for its Dumont Nickel-Cobalt Project. The updated feasibility study delivered a US$920 million Net Present Value (“NPV8%“) based on a large scale, low-cost, long-life project with Initial nickel production in concentrate of 33ktpa, ramping up to 50ktpa in the Phase II expansion. The related report dated July 11, 2019, entitled “Technical Report on the Dumont Ni Project, Launay and Trécesson Townships, Quebec, Canada” can be found on RNC’s website at www.rncminerals.com and at www.sedar.com under RNC’s profile.

Management Appointments

As part of the next phase of RNC’s growth, a number of management changes and additions were made during 2019 and early 2020, with the objective of maximizing the value of each of the assets within the Corporation’s portfolio and advancing RNC’s corporate strategy;

Table 4 – Cash Operating and All-in Sustaining Costs1,2

| For the periods ended December 31, | Q4 2019 | 2019 | 2H 2019 |

| Production and processing costs | $34,821 | $91,600 | $69,934 |

| Royalty expense: Government of Western Australia | 1,168 | 2,667 | 2,047 |

| Royalty expense: Other | 2,768 | 7,138 | 5,210 |

| By-product credits | (787) | (1,959) | (787) |

| Adjustment1 | (3,197) | (12,764) | (11,640) |

| Operating costs (CAD$) | $34,773 | $86,682 | $64,764 |

| General and administration expense – corporate | 1,133 | 2,636 | 1,952 |

| Sustaining capital expenditures | 6,443 | 10,353 | 9,326 |

| All-in sustaining costs (CAD$) | $42,349 | $99,671 | $76,042 |

| Average exchange rate (CAD$1 – USD$1) | 0.76 | 0.75 | 0.75 |

| Operating costs (USD$) | $26,344 | $65,477 | $49,057 |

| All-in sustaining costs (USD$) | $32,083 | $75,304 | $57,600 |

| Ounces produced | 26,874 | 64,277 | 51,090 |

| Ounces of gold sold | 28,359 | 65,225 | 50,368 |

| Cash operating costs (per ounce sold) (USD$) | $929 | $1,004 | $974 |

| All-in sustaining cost (per ounce sold) (USD$) | $1,131 | $1,155 | $1,144 |

| 1. | Negative adjustment for intercompany tolling transactions (2019 Q4: $3,197), (2019 YTD: $12,764) and capital development ($9,096). |

| 2. | Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of RNC’s MD&A dated March 25, 2020. |

Conference Call / Webcast

RNC will be hosting a conference call and webcast today beginning at 10:00 a.m. (Eastern time). A copy of the accompanying presentation can be found on RNC’s website at www.rncminerals.com.

Live Conference Call and Webcast Access Information:

North American callers please dial: 1-888-231-8191

Local and international callers please dial: 647-427-7450

A live webcast of the call will be available through Cision’s website at: Webcast Link (https://event.on24.com/wcc/r/2229149/63F8F15E36E6ED35A33635AC1190BC73)

A recording of the conference call will be available for replay

through the webcast link, or for a one-week period beginning at

approximately 1:00 p.m. (Eastern Time) on March 26, 2020, through the following dial in numbers:

North American callers please dial: 1-855-859-2056; Pass Code: 7561119

Local and international callers please dial: 416-849-0833; Pass Code: 7561119

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, Vice-President, Exploration & Growth, Salt Lake Mining Pty Ltd, a 100% owned subsidiary of RNC, a Qualified Person for the purposes of NI 43-101.

About RNC Minerals

RNC is focused on growing gold production and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations (“HGO”) in Western Australia. The Higginsville treatment facility is a low-cost 1.4 Mtpa processing plant which is fed at capacity from RNC’s underground Beta Hunt mine and open pit Higginsville mine. At Beta Hunt, a robust gold mineral resource and reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO is a highly prospective land package totaling approximately 1,800 square kilometers. In addition, RNC has a 28% interest in a nickel joint venture that owns the Dumont Nickel-Cobalt Project located in the Abitibi region of Quebec. Dumont contains the second largest nickel reserve and ninth largest cobalt reserve in the world. RNC has a strong Board and management team focused on delivering shareholder value. RNC’s common shares trade on the TSX under the symbol RNX. RNC shares also trade on the OTCQX market under the symbol RNKLF.

The content published on Insidexploration.com is based on current events, historical data, company news releases, sedar filings, technical reports and information provided by the companies we work with. These publications may contain forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The publications on Insidexploration.com are for informational and entertainment purposes only and are not a recommendation to buy or sell any security. Always do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Please be sure to read company profiles on www.SEDAR.com for important risk disclosures.

...

Multimedia and analytical due diligence database for the investing community.

About Us

Contact Us

Disclaimer

Privacy Policy

Terms of Service

© Copyright 2022 insidexploration.com

Contact us: insidexploration@gmail.com

© Copyright 2025 insidexploration.com | Multimedia and analytical due diligence database for the investing community | Contact us: insidexploration@gmail.com